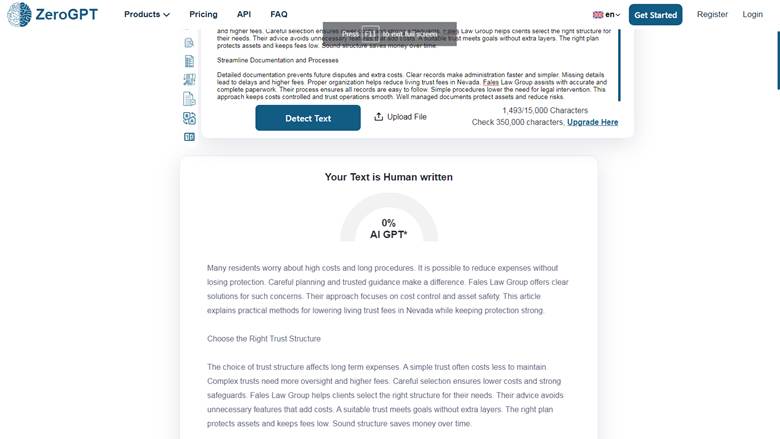

Creating a living trust can safeguard assets and ensure smooth distribution. Many residents worry about high costs and long procedures. It is possible to reduce expenses without losing protection. Careful planning and trusted guidance make a difference. Fales Law Group offers clear solutions for such concerns. Their approach focuses on cost control and asset safety. This article explains practical methods for lowering living trust fees in Nevada while keeping protection strong.

Choose the Right Trust Structure

The choice of trust structure affects long term expenses. A simple trust often costs less to maintain. Complex trusts need more oversight and higher fees. Careful selection ensures lower costs and strong safeguards. Fales Law Group helps clients select the right structure for their needs. Their advice avoids unnecessary features that add costs. A suitable trust meets goals without extra layers. The right plan protects assets and keeps fees low. Sound structure saves money over time.

Streamline Documentation and Processes

Detailed documentation prevents future disputes and extra costs. Clear records make administration faster and simpler. Missing details lead to delays and higher fees. Proper organization helps reduce living trust fees in Nevada. Fales Law Group assists with accurate and complete paperwork. Their process ensures all records are easy to follow. Simple procedures lower the need for legal intervention. This approach keeps costs controlled and trust operations smooth. Well managed documents protect assets and reduce risks.

Limit Ongoing Maintenance Requirements

Trusts often require regular updates and reviews. Limiting unnecessary changes saves money. Frequent revisions increase costs without adding much protection. A stable trust plan avoids repeated legal fees. Fales Law Group designs trusts that need fewer updates. Their plans remain effective for long periods. This reduces maintenance costs and keeps management simple. Fewer revisions mean less administrative burden. Stability ensures protection while lowering expenses over time.

Work With Experienced Legal Guidance

Expert legal guidance prevents costly mistakes. Inexperienced handling can cause errors and extra fees. Skilled attorneys understand how to balance cost and protection. Fales Law Group offers deep experience in trust creation. They guide clients through each step with care. Professional oversight reduces risks and avoids financial waste. Expert support ensures compliance with Nevada laws. This keeps the trust secure and cost efficient. Choosing the right legal partner saves time and money.

Focus on Long Term Planning

Long term planning avoids sudden and expensive changes. A clear vision ensures smooth asset transfer. Strong planning keeps the trust effective for years. This reduces future costs and maintains security. Careful forecasting avoids surprises and urgent legal work. Planning ahead makes trust management easier. It also ensures heirs receive assets without delay. Asset protection remains strong with thoughtful preparation. Lower fees and high security are possible through steady planning. Sound long term strategies protect value and reduce expenses.

You may also like

-

Which fragrance ingredients create the longest-lasting scents?

-

A Beginner’s Guide to Safe and Effective Excavation and Drainage Services

-

What Does a Zoho Implementation Partner Do? A Complete Guide for Business Owners

-

What benefits come from renting snapchat agency accounts?

-

Enhancing Building Safety through Advanced Passive Fire Protection Solutions